The Venus protocol represents a major shift in the decentralized finance (DeFi) scene; it merges the worlds of cryptocurrencies and financial applications. Developed on the Binance Smart Chain (BSC), Venus Protocol is an algorithmic money market that allows users to borrow assets and earn interest. Unlike most traditional blockchain platforms, this protocol enables anyone, anywhere to access low-cost financial services.

One of the central features of the Venus Protocol is its utility tokens, namely VAI and XVS. VAI is a stablecoin pegged to the U.S dollar. By utilizing the over-collateralization function, users can securely mint VAI on the Venus Protocol. On the other hand, XVS is the governance token, which allows holders to propose and vote on the protocol’s upgrades. The system is designed to be decentralized and democratic, valuing the input of its userbase.

An impressive feature of the Venus Protocol is that it offers extremely low fees. With BSC as its foundation, the protocol takes advantage of the speedy and cost-efficient nature of Binance’s native blockchain. This makes it more accessible than ever for users to participate in DeFi, as high transaction costs have long been a barrier to entry in the field.

Moreover, the Venus Protocol excels in terms of security. The platform employs a collateralization mechanism to safeguard users’ assets, making it a highly secure avenue for interaction with DeFi systems. Users can confidently invest, knowing that their assets are protected by robust security measures. In an asset-driven industry where data breaches are constantly on the rise, the Venus Protocol is breaking barriers for decentralized security measures.

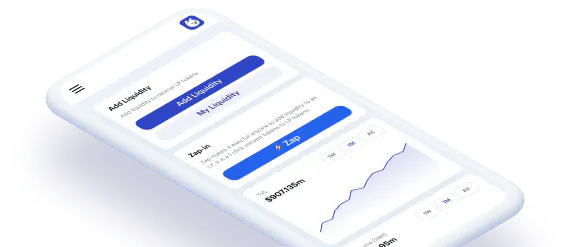

Furthermore, the Venus Protocol promotes inclusiveness and accessibility. The platform’s easy-to-use interface lowers the tech barrier, turning it suitable for all users, regardless of their tech-savviness. The protocol opens the floor for anyone to take advantage of its financial services, marking a significant development in the world of DeFi.

In conclusion, the Venus Protocol is a game-changing financial ecosystem in the DeFi landscape. It offers peerless services in terms of utility tokens, transaction fees, security measures, and inclusivity. As the world of decentralized finance continues to evolve, platforms like the Venus Protocol are leading the charge, demonstrating what is truly possible when we bridge the gap between traditional finance and blockchain technology.